The Indian Premier League’s billion-dollar juggernaut has finally hit a speed bump. For the first time in its history, the tournament’s valuation has declined for two consecutive years, falling to Rs 76,100 crore ($8.8 billion) in 2025 from Rs 82,700 crore ($9.9 billion) in 2024 and Rs 92,500 crore ($11.2 billion) in 2023.

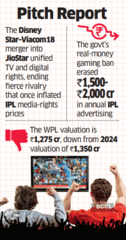

According to D&P Advisory’s 2025 IPL-WPL Valuation Report, titled “Beyond 22 Yards: The Power of Platforms, The Price of Regulation,” the two-year erosion of Rs 16,400 crore reflects a fundamental reset in India’s cricket economy. A combination of media consolidation and the government’s ban on real-money gaming (RMG) sponsorships have taken the sheen off the IPL’s once-unchecked growth trajectory.

D&P identifies two structural shifts behind the contraction. The first was the merger of Disney Star and Viacom18 into JioStar, which unified television and digital rights under one umbrella. The consolidation effectively ended the intense bidding war that previously inflated media-rights values.

The second disruptive factor is the government’s prohibition on RMG advertising and sponsorship. According to D&P, the ban has wiped out an estimated Rs 1,500-Rs 2,000 crore of annual spending from the IPL ecosystem alone. Broader market estimates peg the total advertising loss across Indian sports and media at nearly Rs 7,000 crore, with cricket bearing the brunt.

Santosh N, managing partner at D&P Advisory, said the firm had anticipated a deceleration in growth. “In 2023, when we pegged the IPL’s valuation at $11.2 billion, we had projected a 40-50% appreciation in media rights by 2027. That assumption was based on the presence of two formidable bidders and the possible entry of global tech companies into sports streaming,” he said, adding, “The subsequent ban on real-money gaming (RMG) further constrained the monetisation outlook.”

The last major rights sale in 2022 had set new benchmarks. The Board of Control for Cricket in India (BCCI) sold IPL media rights for Rs 48,390 crore for the 2023-27 cycle.

Disney Star retained the television rights, while Viacom18’s JioCinema won digital streaming. The deal was a threefold jump over the Rs 16,347 crore Star India paid for 2018-22, and almost six times Sony Pictures Networks India’s Rs 8,200 crore outlay for 2009-17. The merger between Disney Star and Viacom18 in 2024 changed the competitive landscape. With both television and digital rights now under JioStar, the fierce rivalry that previously pushed valuations higher has evaporated.

According to D&P Advisory’s 2025 IPL-WPL Valuation Report, titled “Beyond 22 Yards: The Power of Platforms, The Price of Regulation,” the two-year erosion of Rs 16,400 crore reflects a fundamental reset in India’s cricket economy. A combination of media consolidation and the government’s ban on real-money gaming (RMG) sponsorships have taken the sheen off the IPL’s once-unchecked growth trajectory.

D&P identifies two structural shifts behind the contraction. The first was the merger of Disney Star and Viacom18 into JioStar, which unified television and digital rights under one umbrella. The consolidation effectively ended the intense bidding war that previously inflated media-rights values.

The second disruptive factor is the government’s prohibition on RMG advertising and sponsorship. According to D&P, the ban has wiped out an estimated Rs 1,500-Rs 2,000 crore of annual spending from the IPL ecosystem alone. Broader market estimates peg the total advertising loss across Indian sports and media at nearly Rs 7,000 crore, with cricket bearing the brunt.

Santosh N, managing partner at D&P Advisory, said the firm had anticipated a deceleration in growth. “In 2023, when we pegged the IPL’s valuation at $11.2 billion, we had projected a 40-50% appreciation in media rights by 2027. That assumption was based on the presence of two formidable bidders and the possible entry of global tech companies into sports streaming,” he said, adding, “The subsequent ban on real-money gaming (RMG) further constrained the monetisation outlook.”

The last major rights sale in 2022 had set new benchmarks. The Board of Control for Cricket in India (BCCI) sold IPL media rights for Rs 48,390 crore for the 2023-27 cycle.

Disney Star retained the television rights, while Viacom18’s JioCinema won digital streaming. The deal was a threefold jump over the Rs 16,347 crore Star India paid for 2018-22, and almost six times Sony Pictures Networks India’s Rs 8,200 crore outlay for 2009-17. The merger between Disney Star and Viacom18 in 2024 changed the competitive landscape. With both television and digital rights now under JioStar, the fierce rivalry that previously pushed valuations higher has evaporated.

You may also like

India fail to qualify for 2027 AFC Asian Cup after 1-2 loss to Singapore

Banished Celebrity Traitors star 'revealed' as star points out huge mistake

Haryana Dalit IPS officer's 'suicide' heats up polifield

Anant Goenka named FICCI President-elect

Now, public sector companies allowed to buy cars of up to 2,500 cc for staff