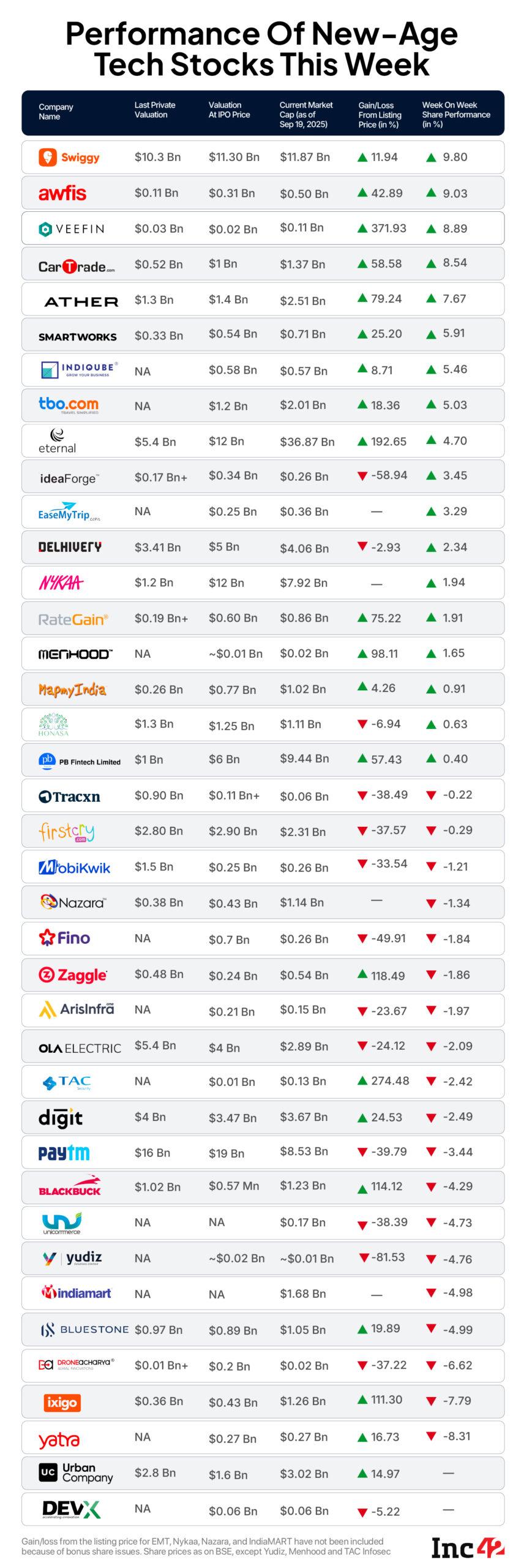

While the bulls dominated the Indian equities market for the third consecutive week, new-age tech stocks continued to see a mixed investor response. Eighteen out of the 37 new-age tech stocks under Inc42’s coverage ended the week with gains in a range of 0.40% to about 10%, while 19 stocks declined in a range of 0.22% to over 8%.

Amid this, Urban Company and DevX make their public market debut this week, becoming the latest addition to Inc42’s new-age tech stocks list. While Urban Company’s shares gained significantly after listing with a premium, DevX’s public listing bid was muted.

After listing on Wednesday (September 17) at INR 61.30 on the BSE, DevX’s shares touched lower circuit in the two subsequent trading days. The stock closed the week 5% lower from the listing price at INR 58.10.

With the addition of the aforementioned companies, the total market cap of the 39 new-age tech companies stood at $110.28 Bn. Minus the market cap of Urban Company and DevX, the cumulative market cap of 37 companies stood at $107.2 Bn, a slight uptick from $105.36 Bn market cap last week.

Swiggy topped the list of gainers this week, rising 9.80% to end the week at INR 461.20.

The second biggest gainer was Awfis, with its shares rallied consistently throughout the week after it announced adding eBay to its list of GCC clients on Tuesday (September 16). The company said that it has enabled eBay’s foray into Bengaluru with a 67,000 sq. ft. innovation hub. The stock ended the week 9.03% higher at INR 617.65.

BSE SME-listed Veefin was the third biggest gainer this week, with its shares soaring 8.89% to end the week at INR 406.10. On Monday (September 15), the company’s board approved a proposal to raise INR 94.1 Cr by issuing fresh equity shares and convertible warrants.

Later in the week, the fintech SaaS company announced partnerships with over 15 leading fintechs and enterprises to deliver digital lending and API infrastructure solutions to them, reinforcing the bullish investor sentiment.

Amid the list of gainers, Smartworks, IndiQube, Eternal and Delhivery touched fresh 52-week highs this week.

Meanwhile, profit booking impacted the likes of Yatra, ixigo and BlackBuck, which gained sharply in the preceding weeks.

Yatra topped the list of losers this week, with its shares crashing 8.31% to end at INR 151.75. To note, Yatra’s shares touched an all-time high of INR 173.80 on September 12.

Similarly, ixigo also witnessed a bearish investor sentiment this week after touching an all-time high of INR 329.90 on September 12. ixigo was the second biggest loser this week, with its shares declining 7.79% to close at INR 285.25.

Dronetech company DroneAcharya was the third biggest loser, with its shares falling 6.62% to INR 64.04.

Now, let’s take a look at the performance of the broader market this week.

Trade Optimism, Fed Rate Cut Fuel Third Week of GainsThe benchmark indices extended their winning streak for the third consecutive week, buoyed by supportive global cues and resilient domestic flows.

The Nifty 50 advanced 0.95% to close at 25,327.05, while Sensex gained 0.88% to settle at 82,626.23.

Sentiment was further lifted by the US Federal Reserve’s first rate cut of 2025, renewed optimism around India-US trade negotiations, and Crisil’s softer FY26 inflation forecast of 3.2%, which strengthened expectations of another rate cut by the RBI later this year.

Robust domestic institutional inflows helped cushion selling pressure from FIIs, while valuation discipline was evident in profit booking of overvalued counters and renewed interest in PSU banks.

On the technical charts, Nifty 50 held firm above the 25,000 psychological mark and now faces resistance near 25,500, with scope to test 25,750 on a breakout. On the downside, the 24,900-25,150 range is seen as strong support.

“Indian equities closed the week on a firm note, supported by broad-based gains and robust domestic inflows. With GST rationalisation set to take effect next week and festive demand strengthening, consumption-driven sectors look well placed,” said Vinod Nair, head of research at Geojit Financial Services.

Ajit Mishra, SVP of research at Religare Broking, said that the resumption of India-US trade talks and the Fed’s rate cut bolstered sentiment, but global uncertainty lingers. “Investors should stay positive yet cautious, with a buy-on-dips strategy in cyclicals like autos and metals, while retaining defensives as stabilisers,” he added.

Next week, markets will react to US President Donald Trump’s executive order imposing an annual fee on H-1B visas, which could weigh on IT companies. Domestically, PMI data, which is due on September 23, and weekly banking/forex data on September 26 will be closely watched, alongside US GDP, jobless claims, and core inflation prints for cues on the Fed’s path.

Now, let’s deep dive into Swiggy and Urban Company’s performance this week.

Swiggy’s Experiment Streak Goes OnShares of Swiggy gained 9.80% to end the week at INR 461.20. While the stock is now up about 12% from its listing price, it is still down over 13% year to date.

This week, the company launched a new food delivery app, ‘toing’, in select locations in Pune, aiming to offer affordable meals priced under INR 250. The move is part of Swiggy’s strategy to diversify its offerings and tap into the value-conscious consumer segment.

Notably, Swiggy’s food delivery vertical has been seeing muted growth compared to the rapid surge in its quick commerce business Instamart.

The revenue of Swiggy’s food delivery vertical rose 19% YoY to INR 1,800 Cr in Q1 FY26, while its profit rose 200% YoY to INR 202 Cr. The company, in its Q1 shareholders’ letter, said it will continue to focus on new innovations “to create new customer propositions which can open up the market further”.

Overall, Swiggy’s loss ballooned 96% YoY to INR 1,197 Cr in the June quarter, while operating revenue surged 54% YoY to INR 4,961 Cr.

Urban Company’s Stellar First Week On The Dalal StreetHyperlocal consumer services unicorn Urban Company made a blockbuster debut on the bourses this week after its IPO closed with an oversubscription of a whopping 103.6X in the previous week. The company’s shares got listed at INR 161 on the BSE, a premium of 56.3% to the issue price.

The stock closed the week at INR 185.10, up 80% above the issue price and 15% from the listing price.

Analysts were optimisticon Urban Company’s IPO. ICICI Direct, in its IPO note, recommended subscribing for the long term, highlighting the company’s robust business model and leadership in the home services sector.

However, it advised investors to focus on the long-term investment horizon, given the company’s current valuation metrics.

Other brokerages like Hem Securities, Deven Choksey and Ventura were also positive about the company.

Looking ahead, the company plans to utilise the IPO proceeds for technological advancements, geographic expansion, and enhancing service offerings to strengthen its position in the rapidly growing home services market.

[Edited by: Vinaykumar Rai]

The post Urban Company Rallies Post-Listing Amid A Mixed Week For New-Age Tech Stocks appeared first on Inc42 Media.

You may also like

How long was Celeste Rivas dead for? Cops look for vital answers in D4vd case, manager Josh Marshall comes under fire

Indore Updates: 153 Booked For Drunk Driving; Mechanic Dies In Accident While Installing Lift; Family Of Raja Raghuwanshi Celebrates His Birthday

A day of Sangam — GST, sharadotsav and autumnal equinox

Asia Cup: Pakistan Were Coming At Us Without Any Reason, That's Why (I) Went After Them, Says Abhishek

Assam Cabinet approves relocation of 10th AP Battalion, bilingual exams, Zubeen Garg memorial