From the second half of this year, it seems like every week, at least one new-age Indian startup is lining up for an IPO. Sure, many were waiting for the right window to get listed on the bourses, to scale, build credibility, and deliver investor exits. Yet, as the IPO pipeline swells, some listings fail to meet the basic litmus test.

D2C meat delivery company Zappfresh’s painfully long IPO was a case in point, and the market’s response is showing it.

Despite being the first D2C meat brand getting listed on the Indian stock exchange, public market investors, particularly the retail segment, have shown a clear disinterest in the company.

It was on the verge of being one of the first new-age startup IPOs to be turned back by the market after the regulator’s green light and that usually comes with a big reputational blot.

Founded by Deepanshu Manchanda and Shruti Gochhwal, the company will complete its prolonged subscription window on Monday, October 6 and with 94% subscription at the time of writing. But it was not smooth sailing.

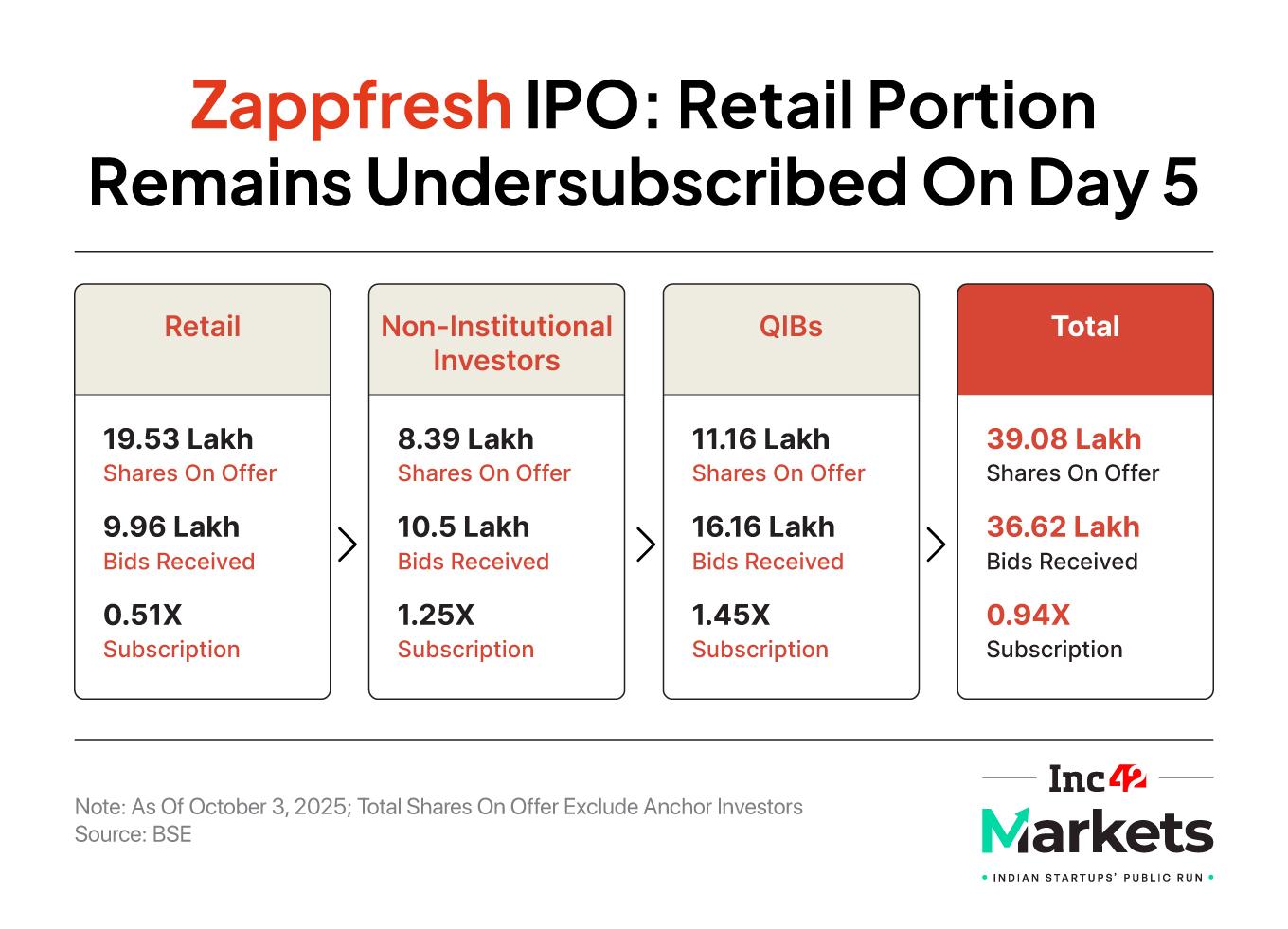

On Day 1, the IPO was subscribed just 21%, crawling up to 52% by the end of the third day (September 30). And it was only on Friday that it crossed the 90% mark, after bidding was left open for five whole sessions. And the company had to reduce its price band marginally.

Even if Zappfresh has now cleared the hurdle, what explains this poor traction?

And although it is a BSE SME IPO with less than INR 60 Cr being raised, the stuttering IPO is nonetheless a serious concern for Zappfresh.

There are questions being asked among analysts. Such as why Zappfresh went for an IPO when it could have banked on its existing investors for the raise — small as it was. Existing shareholders include the likes of Dabur Family Office, LetsVenture, Ah! Ventures, HT Media, SIDBI VC, among others. Just two years back, the startup had raised half its IPO target or INR 30 Cr from some of these investors.

Was an IPO a stipulation for this fundraise for the 10-year-old company? Or was it purely Zappfresh looking to step up to the public markets like many startups of its vintage?

While there is much speculation about Zappfresh failing to raise a private round before the IPO, let’s not focus on the past. What went wrong now for Zappfresh, especially with the bullishness in the air for startup IPOs? And does this signal a caution for the next wave of startup IPOs?

Demystifying Zappfresh’s Extended IPOAnalysts unanimously believe that the public market investors are concerned about Zappfresh extracting much scale from a market where giants like Licious and FreshToHome have also faced difficulties, due to local, unbranded competition and the distribution disruption from quick commerce.

This is perhaps why Zappfresh’s valuation was flagged as a concern. Datum Intelligence founder Satish Meena said that investors are unsure how much growth the company can demonstrate or market share it can increase with just INR 60 Cr raised via the IPO.

“They are asking if the company will be able to at least defend its market share against the big online players. If Zappfresh doesn’t have that kind of capital like the bigger brands, will it be able to fight them for long?”

Meena also told Inc42 earlier this year that online meat brands are struggling with low growth rates, perishability and high wastage, and higher pricing than local shops. Quick commerce private labels have also eroded the advantage that these startups had.

“The expectation in the industry is that, in a couple of years, the quick commerce companies will again try to enter the meat segment once they have better cash flow, because they own the distribution, will have better data, making them well-positioned to set up a better supply chain,” he said.

With these looming shifts on the horizon, retail investors are less confident whether a small brand like Zappfresh can give them double or triple returns on their investments. This is especially true for those investors who back IPOs.

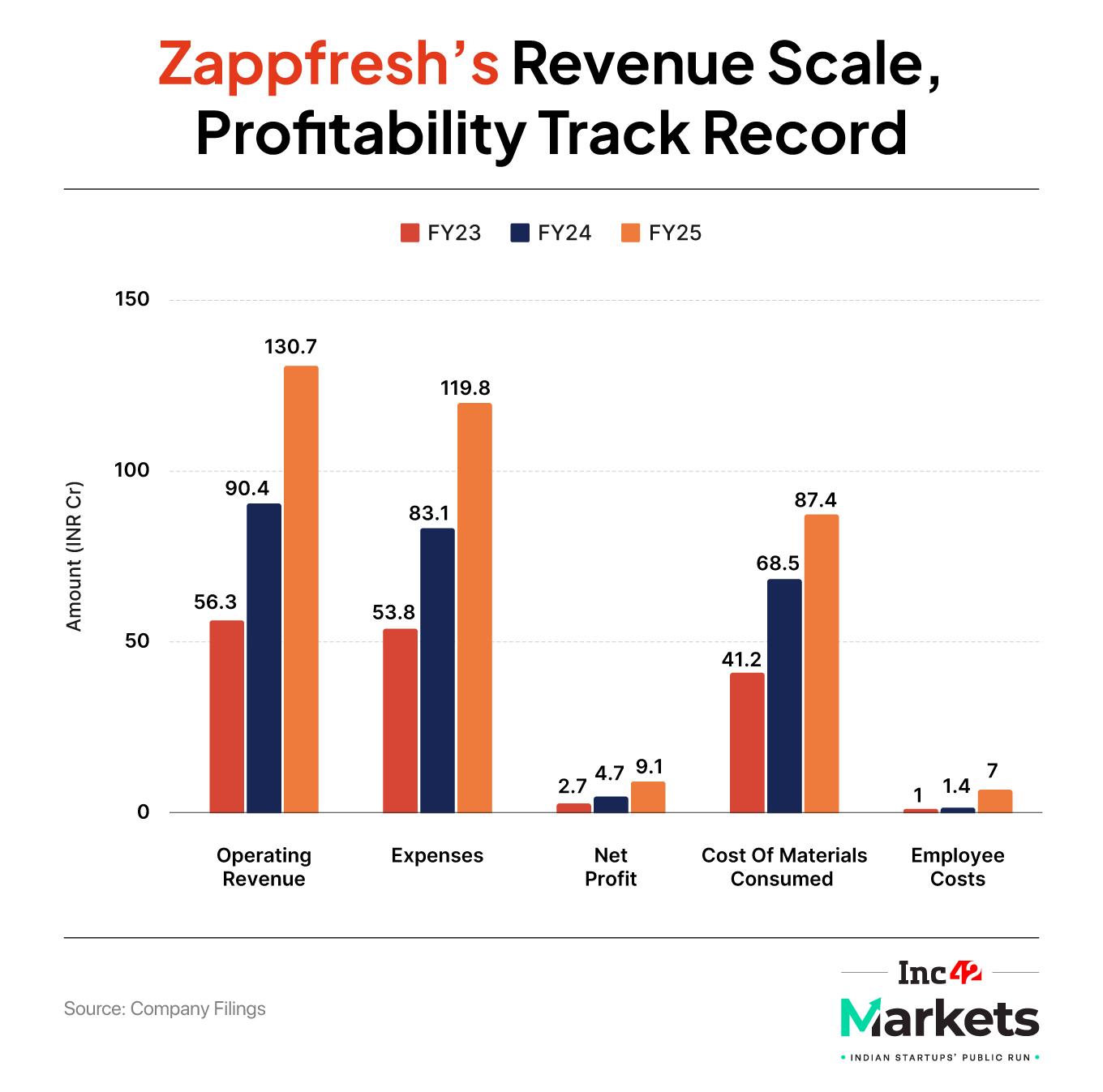

It is important to note here that Zappfresh’s fundamentals are not lacklustre. It is a profitable entity and has witnessed reasonable growth in both top and bottom lines over the last three fiscals. In FY25, for instance, its net profit saw a 94% on-year jump to INR 9.1 Cr while sales revenue was up 45% year-on-year.

Zappfresh’s business strategy has also evolved in tandem with the changing dynamics of geography and food habits. Expanding beyond the regions like UP, Haryana, and Maharashtra, which have statistically lower non-vegetarian food consumption compared to many other regions in the country, the Gurugram-based startup has also tried to establish a stronger market in Karnataka.

The 2023 acquisition of Bengaluru-based Dr. Meat has been instrumental in that. And today, it earns a lion’s share of revenue (almost 43%) from Karnataka, followed by Delhi (19.4%).

But, once again, it is hard to ignore the growing dominance of Licious, FreshToHome, and other quick commerce players if you are a smart investor.

In the eyes of equity analysts, what matters most in the public markets is not just current financial performance but long-term visibility, and that’s where investor scepticism about Zappfresh seems to stem from.

Besides, there are other red flags too. Simranjeet Singh Bhatia, senior equity research analyst at Almondz Group, pointed to the INR 32 Cr debt in Zappfresh’s books. “The kind of debt they currently have in their books is also contributing to the slow subscription in the IPO besides the competition concerns.”

Meanwhile, Ponmudi R, CEO of Enrich Money, noted that being listed on the SME platform raises liquidity and exit concerns, and its valuation at 25X of its earnings (INR 223 Cr) leaves little room for listing gains.

“Additionally, the business itself is heavily skewed toward chicken (55%+ of sales), making it vulnerable to disease outbreaks and supply disruptions. Growth has also slowed — B2C revenue is rising only 10% YoY, while B2B is expanding but carries higher logistics and receivables risks.”

But there is more to the story…

What Do The Public Market Trends Depict?The stock broking firm founder, Ponmudi, interestingly pointed out that of India’s 224 public listings this year, nearly half are trading below their respective issue prices.

“The contrast is sharp: mainboard IPOs are relatively stable, with only 22% in the red. But in the SME space, the picture is harsh — 56% of listings are underwater, some down 20–30% from issue levels, and many 50-60% off from their listing highs… Retail fatigue has set in. Large lot sizes, weak grey-market premiums, and capital stuck in earlier losses have drained enthusiasm.”

Added to this is global volatility, US-India conflicts, and FPI outflows, which have lowered the investors’ risk appetite.

Bhatia, on the other hand, believes that multiple corporate governance issues and SEBI’s tightening regulations in the SME IPO market are also keeping retail investors cautious.

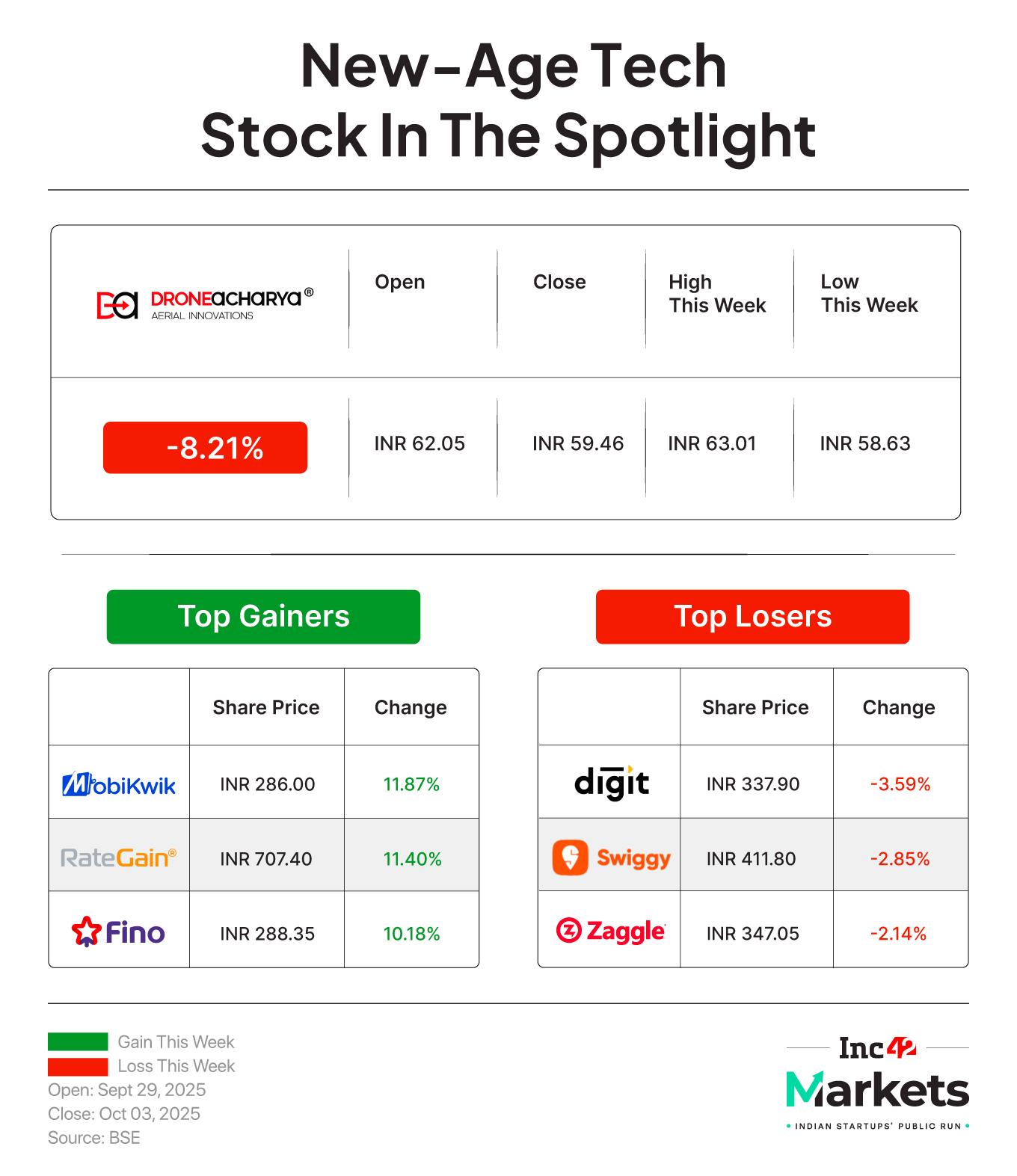

The equity analysts believe that even the mainboard IPO trajectory is also changing. Even a much-hyped public listing of BlueStone saw a muted public market response.

Now, WeWork has also started its IPO on a slow note, and analysts say that the market is now unforgiving. Ponmudi stated that whether it’s global names like WeWork or any companies with a history of burn or governance issues, the market’s tolerance for losses is over.

“IPOs were once seen as easy money — just applying felt like a win. Now, with half the counters in the red, the frenzy has cooled. Investors are focusing on fundamentals: liquidity, profitability, and sustainable growth. Zappfresh is simply the latest casualty of this shift,” he added.

So, while Zappfresh has its own weaknesses, this IPO also carries a bigger reminder, perhaps — it’s time to ride the IPO wave mindfully unless one wishes to drown.

Markets Watch: New Listings, Deals & More- LensKart Gets SEBI Nod: Reportedly, the eyewear brand received the regulator’s approval for its INR 2,150 Cr+ IPO this week

- WeWork Weak Day 1: The co-working major’s IPO received 4% subscription on the first day, as 11 Lakh shares got bidding against 2.54 Cr shares on offer

- MobiKwik Boosts Its Lending Game: The company received its board’s approval for an investment of INR 9.99 Cr in its NBFC subsidiary Mobikwik Financial Services Pvt Ltd (MFSPL)

- Goldman Sachs Ditches Eternal Shares: The financial services company offloaded 1.9 Cr shares in Eternal in two tranches via block deals

- Zaggle Raising Funds: The fintech SaaS player got board’s approval to raise INR 59.99 Cr from preferential allotment of warrants

- TBO Tek Completes Classic Vacations Deal: Its deal worth $125 Mn to acquire US-based luxury travel wholesaler Classic Vacations saw a completion

- Aequs Files Updated DRHP: After getting SEBI’s nod for its confidential draft papers, the contract manufacturer issued an updated DRHP for an IPO comprising fresh shares worth INR 720 Cr and an offer-for-sale (OFS) component of 3.2 Cr equity shares

[Edited by Nikhil Subramaniam]

The post Zappfresh’s Stuttering IPO appeared first on Inc42 Media.

You may also like

NJ 'stalker, killer' Vincent Battiloro is a Charlie Kirk fan, ranted against two girls on livestream before killing them in road rage

Killer Paul Mosley jailed for manslaughter of six children in house fire dies

Bihar polls: No SIRround sound; Election Commission silent on number of 'aliens' deleted

SC rejects Tamil Nadu minister Senthil Balaji's plea in money laundering case

Eight arrested in connection with Cuttack violence, bandh underway amid heavy security